Browsing The Drudge Report last night I came across a shocking headline (Drudge’s specialty): “ROB THY NEIGHBOR: HALF OF HOUSEHOLDS PAY NO FED INCOME TAX…”

Shocking! You mean to tell me Mr. Drudge that the 50% of the country that isn’t Black or Hispanic is supporting the other half of the country by paying the entire nations taxes? That’s like, a lot of people and a lot of money. Right? Damn freeloaders.

The link from Drudge led me to this article on Yahoo, an article which details a study by the Tax Policy Center (a joint venture between the Brookings Institute and the Urban Institute) which came to the conclusion:

About 47 percent will pay no federal income taxes at all for 2009. Either their incomes were too low, or they qualified for enough credits, deductions and exemptions to eliminate their liability.

Tax breaks in action! For a family of four with two children under 17 and two parents collectively making $50,000 a year, these families can expect to pay little to no money in federal income tax due to tax breaks, tax credits, and other deductions they will qualify for, being all in the low income tax brackets and such. The Tax Policy Center is a trusty and more or less non-partisan institute and from their findings you can draw one of two conclusions: either this study is demonstrating that government tax relief and tax breaks are working in the favor of those low income individuals they were designed to support or you see that 50% number and you think to yourself “those selfish thieving lazy good-for-nothings are taking all my tax money! Unfair!”

Readers of The Drudge Report were no doubt feeling the latter impression from the study. With our Communist in Chief in the White House it’s no surprise that half of the country is getting welfare rich off the backs of us hard-working tax-paying CEOs and Board of Directors directors! This information, along with what Chuck Norris and Jon Voight have told me, will only further justify me not paying my income taxes this year. Take THAT you shotgun-welding IRS agents!

Like most right-wing hate and anger though, you really need to look at this story and wonder if it’s at all justified, if this SHOCKING headline is anything new or if this result is the product of some other force beyond the Obama administration.

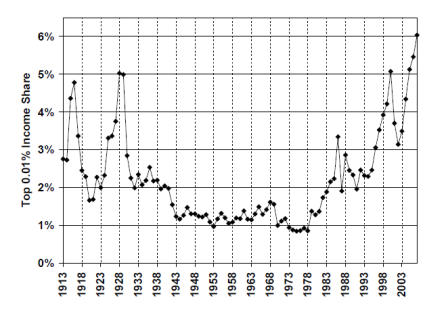

In short, it should come as no surprise that 50% of the country not only qualify as “low-income”, and therefore can receive these tax credits, but also that this large portion of the country doesn’t make enough money to even make a meaningful contribution to the tax system. Even more shocking than 50% of the country reaching a zero-sum with their tax payments is that a RIDICULOUSLY small percentage of the United States holds the vast majority of the wealth in this country, and they’re making more money than ever before!

According to Berkley professor Emmanuel Saez, the top 1% of wealth earners in the United States took home 49.7% of the total income out there in 2007:

“The top 1 percent incomes captured half of the overall economic growth over the period 1993-2007,” Saes writes.

Economic inequality is nothing new in the United States of America, but you’ve gotta wonder here who is robbing whom in this situation? Is Drudge’s headline right in blaming the bottom 50% of Americans, who qualify for federal tax breaks and credits, and accusing them of “robbing” the wealthy earners in society, or is it the top 1% of wealth earners in the United States who are brining home 50% of the total wages out there and are robbing the other 99% of us in this country?

Did you see that? Any argument for a Flat Tax just flew right out the window. Sorry Groover Norquist.